Reach your credit and money goals

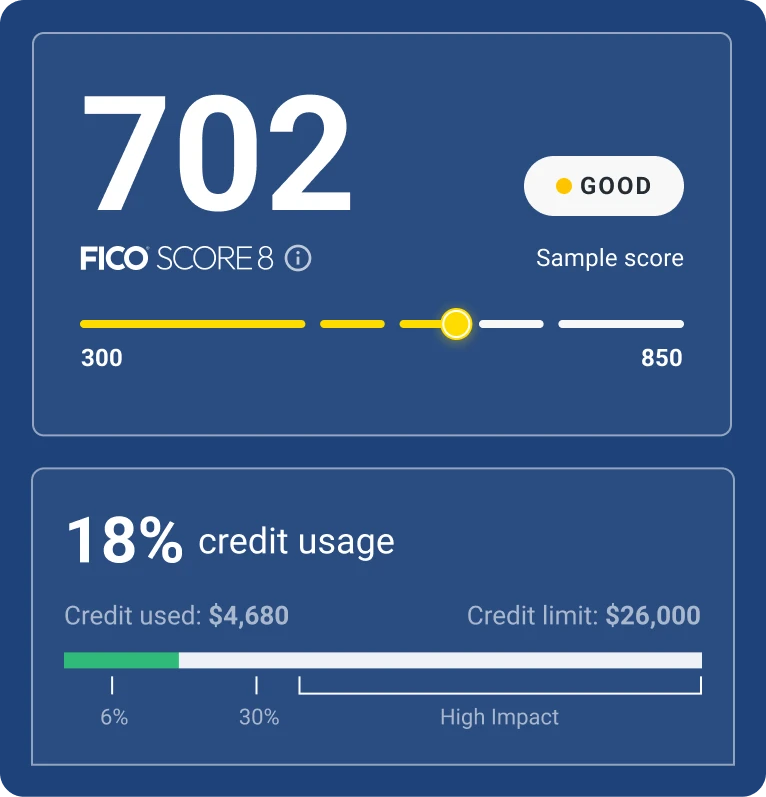

Get your free credit report and FICO® Score*

Then raise your credit scores instantly using bills like your cell phone, utilities, streaming services and eligible rent payments.ø

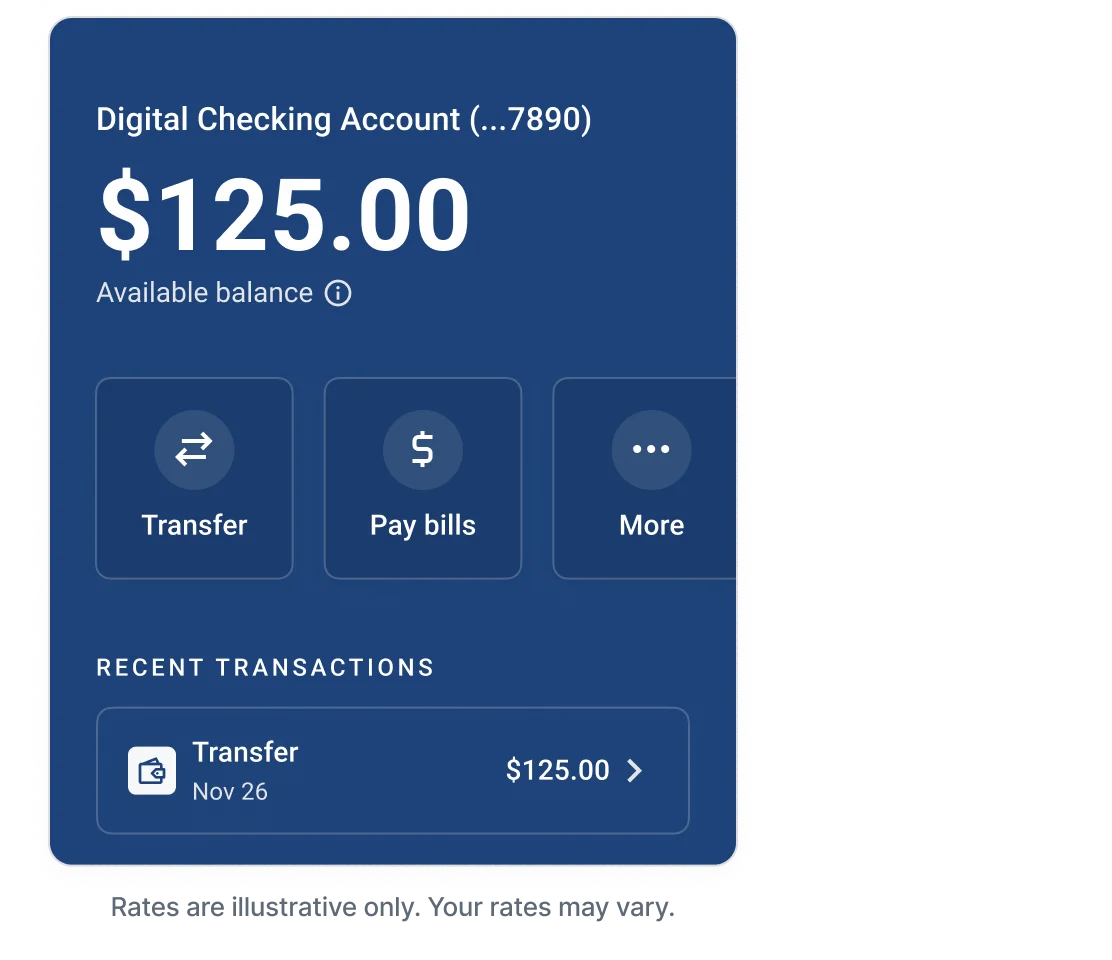

Let's get startedA digital checking account that helps you build creditø

Introducing the new Experian Smart Money™ Digital Checking Account, designed by credit experts. Enjoy no monthly fees¶, use eligible bills to raise your credit scoresø and more.

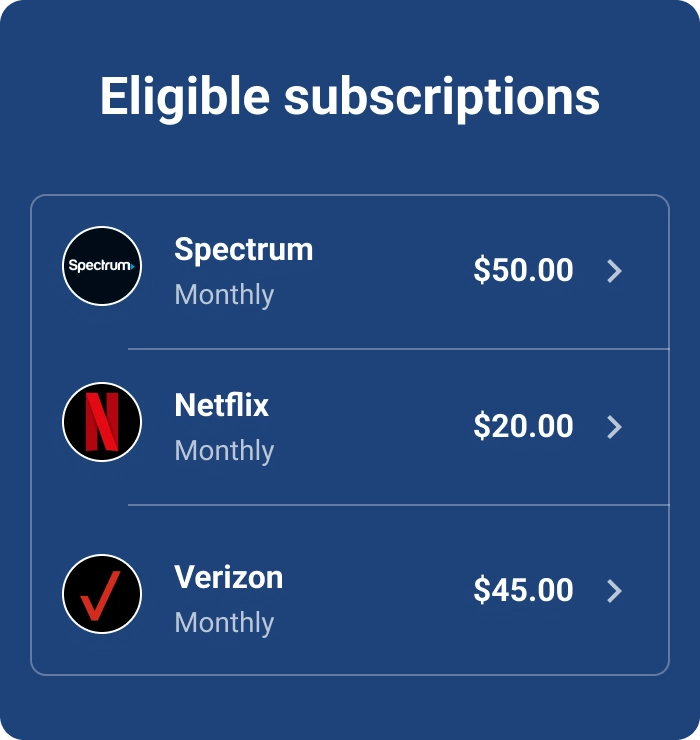

Sign up in minutesSave up to $670 a year on your subscriptions and billsφ

Let us cancel or lower over 250 eligible subscriptions and recurring bills for you in a few easy steps.

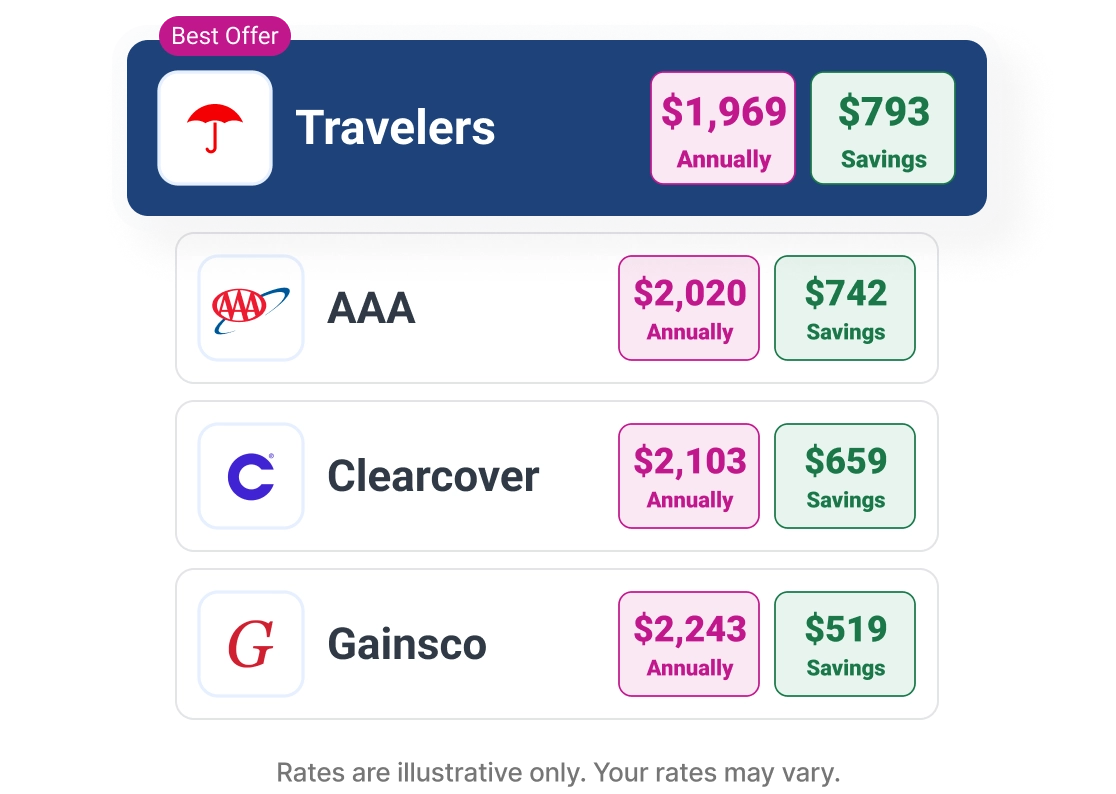

Sign up nowSave $961 a year on auto insuranceβ

Stop overpaying for auto insurance. Let us compare quotes and shop for you to get our best rate—for free.

Start for free

Check out credit card offers matched to you

Whether you’re looking to build credit, earn rewards or get cash back, find the best card matched to your unique credit profile.

See your matches

Financial power in your pocket

Get credit alerts straight to your phone, manage your money on the go and more. Free with your membership and the Experian app.

How can we help?

Manage your credit basics with these free tools.

The Experian Smart Money™ Debit Card is issued by Community Federal Savings Bank (CFSB), pursuant to a license from Mastercard International. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank.

§Funds in your Experian Smart Money™ Digital Checking Account are held in a pooled deposit account at Community Federal Savings Bank and insured up to $250,000 for each account ownership category. Learn more at FDIC.gov.

ӂThe Experian Smart Money™ Digital Checking Account is only available to residents of U.S. states and the District of Columbia.

øResults will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®. Learn more.

‡To be eligible for the $50 bonus, your Experian Smart Money™ Digital Checking Account must be credited with at least $1,000 in direct deposits within 45 business days of opening your account, and your account must stay active and in good standing at the time the bonus is paid. The bonus will be deposited into your account within 10 business days, once earned. Limit 1 bonus per cardholder. Offer subject to change by Experian at any time without prior notice. Terms and conditions apply. See the Incentives section in the Cardholder Agreement to learn more.

†Early access to your direct deposit depends on the timing of receipt of the incoming direct deposit file. We generally make direct deposits available up to 2 days earlier than the payment date specified in the direct deposit file. Early availability of direct deposits is not guaranteed and may vary from deposit to deposit. Daily and monthly deposit limits apply. See Cardholder Agreement.

**Access to over 55,000 surcharge-free ATMs with the Allpoint ATM network. You may be charged a fee for attempting a cash withdrawal with an out-of-network ATM or point-of-sale device by Experian and/or the operator including for a balance inquiry even if you do not complete a cash withdrawal. Learn more.

#Limits apply. See Cardholder Agreement.

Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

¶See the Experian Smart Money™ Digital Checking Account & Debit Card Agreement.